Introduction: Global Travel

The world is preparing its bags once again! The world has been sleeping through years of the pandemics, but now the world travel is seeing a strong revival. Global travelers flock back, air tickets are being purchased at a record pace, and major tourist spots are filled again with lots of excitement. But, beneath this stream of optimism will be some counter-currents: one of which is the U.S. travel sector, which in most years was a monster of momentum, is this year manifesting itself a key sluggard of total travel. As the rest of the world is getting on the right track, the U.S. recovery is stumbling, which affects the speed and opportunity of the whole sector reviving. this unexpected twist, let us unwrinkle it.

The World on the Move: A Surge in Global Travel

One cannot deny the positive trend of international tourism. The international tourism is roaring back due to bloated demand, a drop in restrictions and a general eagerness to get back to one another.

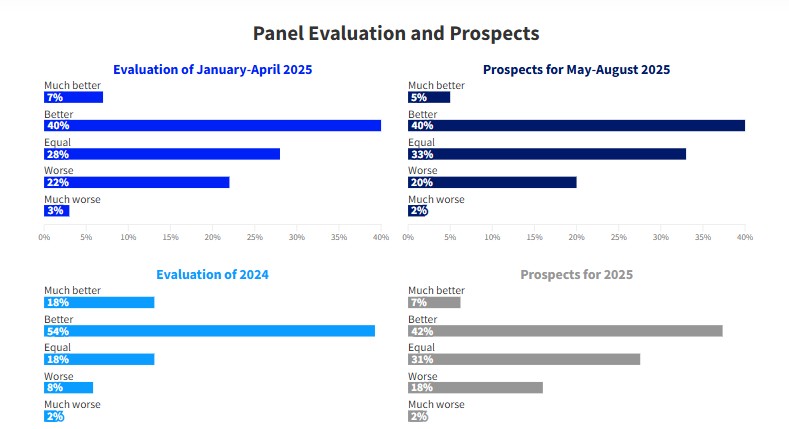

- Soaring Demand: As per the World Tourism Organization (UNWTO), the number of international tourist arrivals in 2023 was 88 percent of those recorded before the pandemic, and the robust growth is to be sustained in 2024. The trend is being driven by the regions such as Europe, Middle East and Africa which tend to surpass the norms of 2019. Load factors at the international flights of the airlines are also uniform and high.

- Unleash the Spending Power: The strong point is the healthy travel spending. Tourists are not only traveling, but are usually spending more on each journey. Luxury experiences, extended vacations as well as revenge travel excesses are making a major impact in increasing tourism revenues in most destinations. Tourist-dependent countries are heaving a sigh of relief because this economic lifeline is boosted.

- Local Heroes: Spain, Greece, Turekiye, Japan and Saudi Arabia are experiencing record-breaking numbers. Streamlined issuance of visas; niche marketing and emphasis on multicultural experiences (culture, gastronomy and adventure) are working. The Asia-Pacific region is reopening more slowly but is currently catching up.

This recovery is so extensive that it gives an image of a robust industry. Yet, the total travel momentum is yet to live to its full potential and a large part of that is because of one major market falling behind.

The American Anomaly: Why the U.S. Travel Industry is Lagging

As the world continues to travel luxuriously, the American traveling market offers a confusing scenario. Although its home recovery is strong at first, its international outlooks and general contribution to recovery in the world are quite low. There are some headwinds building because of several related factors:

- The “Passport Backlog”: Bottleneck For years, the U.S. State Department has struggled to come out of the hole they found themselves in–with a record number of passport applications as well as renewals. Waiting times that were improving are still tremendously higher than those that existed prior to the pandemic. This directly denies millions of possible American travellers the chance to make up-country trips, which strangles the outbound tourism expenditure.

- Wait Times at Visas: The biggest hindrance to inbound travel: The case is even worse when it comes to those who want to travel into the U.S. The wait times on visitor visa (B1/B2) appointments in most key markets is in the hundreds of days in markets like India, Mexico, Brazil and China. This creates a strong formidable disincentive, which has kept millions of prospective tourists and businesspeople out of sight and away, which is a direct blow to travel expenditure in the U.S.

- Competitive Disadvantage: Travelers experience a year-long wait when applying to a U.S. visa, competitor destinations (such as UK, Schengen Area and Canada) have simplified the procedure, allowing faster online or visas waivers in some cases. This simplifies the decision making power in the selection of alternative destinations that would avoid travel expenditure in the U.S.

- Economic Headwinds and Perception: Inflation worry, recession worries, and air fare (particularly when traveling internationally out of the U.S.) have caused some people in America to shy away on larger international journeys. However, at the domestic level even though it is very strong, a high hotel and rental car prices could also be persuading some travelers to cut trips or reduce plans, having a subtle negative influence on domestic travel momentum also.

- Staffing issues have not gone away: Although this is getting better, airports, hotels, and restaurants in the United States continue to experience difficulties with staffing sufficiency, which leads to slower service and service breakdowns, which could sour overall visitor sentiment and reducing the power of word-of-mouth marketing to support continued levels of travel.

The U.S. Travel Association consistently highlights these visa and passport issues as the primary drag on the sector. Geoff Freeman, U.S. Travel Association President and CEO, has stated, “The U.S. is losing millions of visitors and billions in travel spending due to visitor visa wait times that remain unacceptably high… This is a significant self-inflicted wound on our economy.”

Measuring the Drag: Impact on Travel Momentum and Spending

The lag in the U.S. travel industry isn’t just a domestic problem; it has tangible consequences for the pace of global travel recovery:

- Slower Overall Growth: The U.S. is traditionally one of the world’s largest outbound tourism markets (by spending) and a top inbound destination. When such a massive player underperforms, it inevitably slows the aggregate growth rate of global travel. Forecasts for total international arrivals and revenue would undoubtedly be higher if the U.S. was firing on all cylinders.

- Billions in Lost Spending: Estimates suggest the U.S. is forfeiting billions of dollars annually in inbound travel spending solely due to visa delays. This represents lost revenue for airlines, hotels, attractions, restaurants, retail, and local economies across the country. Outbound travel spending is also suppressed by passport delays.

- Weakened Travel Momentum: Momentum is about pace and energy. The persistent challenges in the U.S. create friction points that disrupt the smooth flow of travelers and capital. This friction makes the overall travel momentum feel less robust and sustainable than it could be. Industry analysts watching global travel trends constantly factor in the U.S. drag.

- Missed Opportunities: Every delayed visa or passport represents a missed connection, a postponed business deal, a cultural exchange that didn’t happen, and economic activity that didn’t materialize. This cumulative effect dampens the vibrancy and potential of the global travel ecosystem.

Beyond Borders: The Ripple Effects

The impact extends beyond pure statistics:

- Airlines and Global Networks: U.S. and global-based airlines with a heavy presence in transatlantic and transpacific markets experience weak demand on other U.S.-centric routes relative to the rest of the world affecting their network plans and profitability. This has the potential indirectly to impact connectivity and capacity in other places.

- Global Destination Strategies: Destinations that have long depended on American tourists are diversifying their efforts in marketing and the source markets, ahead of schedule. This change though healthy in the long run needs adaptation.

- Business Travel and Investment: The existence of lengthy visas causes delays along with international conferencing, corporate meetings, and any business based travel into the U.S. which could impact innovation and any growth in the future of business.

- Perception Matters: This negative perception of U.S. as an inconvenient or hostile destination because of entry hassles can create a long-term negative impact further stifling the regeneration of the U. S. travel industry as compared to any other global travel trends.

Silver Linings and the Path Forward

Despite the drag, there are positive signs and potential solutions:

- Domestic Resilience: The U.S. domestic market remains relatively strong. Americans are exploring their own vast country, supporting local economies and keeping a base level of activity within the U.S. travel industry.

- Government Action (Slowly) Happening: Recognizing the economic damage, the U.S. government has taken steps. State Department hiring surges have reduced passport processing times significantly from their peak. Pilot programs for stateside visa renewals for certain existing H-1B holders have been announced, and there’s sustained pressure to find solutions for visitor visa backlogs. Continued focus and resource allocation are critical.

- Innovation and Adaptation: Industry itself is becoming innovative – using technology to have smoother experience, coming up with innovative attractions, using markets where the visa process is smoother. The U.S. destinations are doubling their efforts in marketing to the domestic and accessible international markets.

- Long-Term Optimism: The fundamental desire to travel is undeniable. Once the procedural bottlenecks are cleared, there’s immense pent-up demand for travel to and from the U.S. The underlying strengths of the U.S. as a diverse destination remain attractive.

The Global Travel Jigsaw: U.S. Piece Needs Fixing

The thread is simple: international travel is surging strongly on freed demand and strong travel expenditure growth in most areas of the world. However, this positive travel trend is definitely crippled by the fact that the industry of travel in the United States is failing. The long-term effects of passport backlog and most importantly, long visitor visa queues are not the wind beneath the wings, but rather the millstone around the neck of the U.S. economy drawing them billions of dollars and leaving the travel industry to languish in the dark without meeting its full potential.

To make the global recovery in the travel industry go into high gear, the issue of bottlenecks which affect the U.S. travel business can not only be called an American issue to be resolved, it is a global issue that needs a solution. Efficient entry processes are not simply about the convenience, but also about unleashing the billions of economic activities, international relations and letting that great machine of global travel is finally unleashed and not hindered by its biggest obstruction. The world is on the move. The U.S. needs to get off the fence and join the bandwagon it should have been providing.